98% of the 200,000 businesses located in New York City are small (fewer than 100 employees) and 89% are very small (fewer than 20 employees). For many people, running a small business in New York City is the epitome of the American Dream. If you’re considering launching a business in the Big Apple, it’s important you learn about licensing, insurance, and tax laws, so you know what to expect as a small business owner.

GETTING A BUSINESS LICENSE

While not every small business requires a license of permit to operate in New York state, many do. If your business is related to food, alcohol, agriculture or the environment, you’ll likely need specific licenses or permits. Visit the NYS Business Wizard and enter details of your business to find out the licenses and permits you need and the cost. You should also check the New York City Business Wizard website for licenses you need at the local level. Most licenses can be applied to online for a minor fee. The total cost varies from as little as $25 to up to several hundred dollars, depending on the business

SMALL BUSINESS INSURANCE

Small businesses with employees in New York are legally required to have workers’ compensation insurance, Cerity.com advises. Workers’ compensation insurance is essential for protecting both you and your employees. Although health and safety should be a priority, sometimes accidents happen. Workers’ compensation insurance protects employers from expensive legal repercussions and covers employees lost wages and medical expenses. In New York, you’re also legally required to have disability benefits insurance and auto insurance (if your company uses a business vehicle).

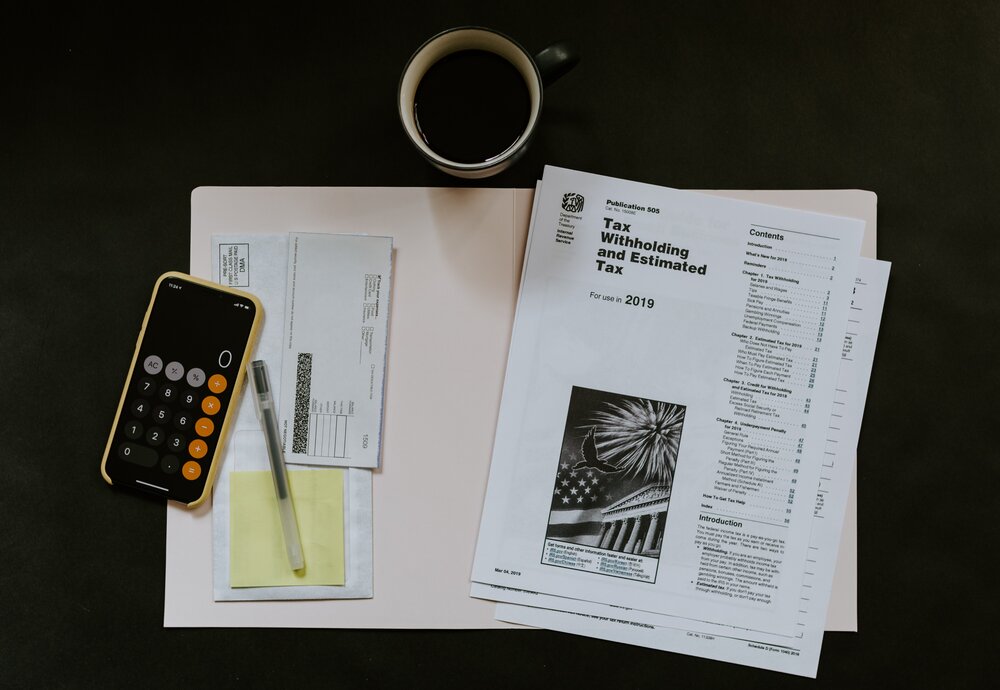

THE LOWDOWN ON TAX

New York businesses are required to file annual sales and use tax returns by March 1st. This is essentially a detailed summary of your business activities, including taxable sales, nontaxable and exempt sales, gross sales, credits you claim on your return, and other relevant information. Annual sales tax filers must fill out state Form ST-101, the New York State and Local Annual Sales and Use Tax Return. However, in some cases, businesses are required to file quarterly returns instead. Visit the New York State Department of Taxation and Finance website to learn more.

A thriving city with a spirit of entrepreneurship and individualism, there’s nowhere better to launch a business than NYC. Researching licensing, insurance and tax laws will ensure you start your business off confidently and on the right foot.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.